How To Create a Dynamic Fintech App? – Take a Step-by-Step Guidance Here

January 3, 2024

Table of Contents

- What is a Fintech App?

- Types of Fintech Apps

- Future Developments in the Fintech Industry

- Features You Must Have in Your Fintech Application

- Points to Consider When You Develop Your Robust Fintech App

- Steps to Develop a Fintech App

- Mistakes You Must Avoid While Developing a Fintech App

- What is the Cost of Developing a Fully Featured Fintech App?

- How Can Softqube Technologies Help You Create the Best Fintech App For Your Business?

- FAQs

From all the industry startups we see growing around the market, Fintech is gradually picking up its pace with great consistency. The phenomenal rise in number of fintech apps and platforms launching every day worldwide shows a promising future. Reports also project 11.72% CAGR growth between 2024-2028, reaching up to 355.57 by 2028. The last decade was a revolutionary period when we saw some of the top fintech companies transforming into customer-centric businesses with the power of technology.

The market is burgeoning with tough competitors offering innovative services, and it will be a commendable task to surpass this level of competition. You can raise the bar and win this game only by gauging the future possibilities and taking action on time.

First of all, you need to identify the right ways to develop your fintech app, decide what features you need, and find your right target audience. Secondly, you must have a skillful app development team that follows the best practices of fintech app development and can help you launch your product with grand success.

The blog will help you find everything in a gist so that it becomes easier for you to delve deeper and research more before you decide to develop a fintech app for your business.

What is a Fintech App?

A Fintech app is a kind of software application created to digitize and automate financial services. They are innovative types of products offered by fintech app development companies for the fintech industry. By combining finance and technology, fintech apps enhance access to financial services and stand out as a better choice as compared to traditional financial institutions.

With the power of Fintech apps, your financial business can become simple and efficient in many ways, as it can offer you alternative financial systems like blockchain and crypto that are remarkably secure and safer than other options.

Fintech app development companies provide solutions such as developing web, mobile, or desktop apps for online banking, digital payments, and budget management. These apps are now trending in the market and are used by many tech-savvy users like entrepreneurs, banks, and companies for practicing safe, secure, and reliable solutions, saving time and work in handling finances.

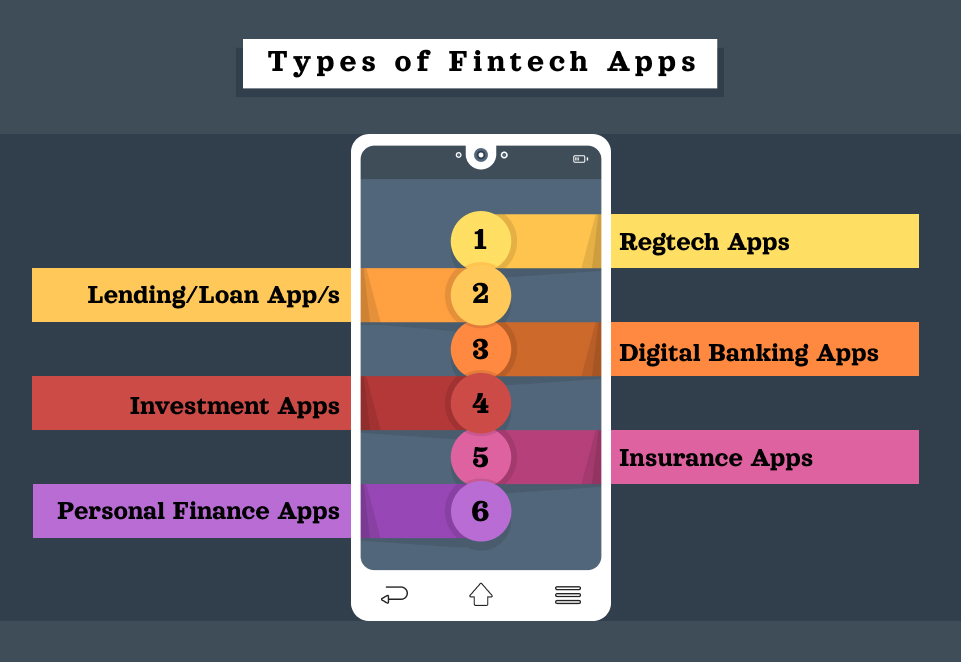

Types of Fintech Apps

The financial sector is wide and massive with various types and categories to explore. Some of the mainstream apps that have worked well these days are:

Digital Banking Apps

They are online banks offering a fast and easy method to handle banking operations like loans, balance checking, and so on. Various fintech startups are now developing such apps to enter the market. Even traditional banks are realizing the need for such banking apps as they provide different kinds of services online to users.

In addition, mobile banking has been the mainstream service provided by banks for years giving access to financial services like knowing bank balance, etc. Some of the popular digital banking apps are Chime, Ally, and Starling.

Insurance Apps

Insurance apps mainly provide different types of insurance services like vehicles, health, life, gadgets, and more. The primary goal of such apps is to enhance the insurance policy administration and claim process. Simultaneously, these apps ensure the reduction of insurance fraud risks. These apps offer affordable insurance policies with 24/7 dedicated customer support.

Lending/Loan App/s

They are mainly created to provide quicker loan access through peer-to-peer lending platforms or traditional. They provide good opportunities for both types of platforms and even for digital lenders. These apps include features like billing, additional offers and rewards, loan application forms, credit score checker, and much more.

Investment Apps

In the past, stock market investment was not accessible to everyone. With digitalization in financial services, everyone has a demat account and can begin trading on their own. Investors can get daily insights about the stock market trends and they can invest in national as well as international stocks, gold, mutual funds, and much more.

Nowadays, with the power of machine learning algorithms, Robo-advisory apps have become very popular, and they include data and risk-based investment advice.

Personal Finance Apps

These apps come in different types such as bill reminders, budgeting, tax preparation, expense tracking, and credit monitoring. Users can handle their finances here starting from helping users get knowledge about personal finance trends. These apps also offer digital accounting operations and give personalized tips.

Regtech Apps

The financial industry involves several risks and therefore needs strict regulations to avoid loss to the economy and people’s finances. Moreover, there is a lot of sensitive information that needs to be protected such as social security numbers, bank account information, and credit scores, from any fraudulent activities.

Regtech apps offer enough guidance to financial institutions and make sure everyone is compliant with the rules, can manage identities, report to regulators, and can monitor risks. These apps majorly rely on upcoming technologies like Machine learning and Big Data for automating regulatory operations.

Future Developments in the Fintech Industry

The influence of fintech applications in the financial services industry is rising sharply. And in the coming years, we will see the following trends and benefits of having such an app and winning an edge over the competitors.

Multi-Payment Options

We are watching the world practicing innovative contactless payment options like e-wallet, net banking, UPI, cryptocurrency, and so many more. These payment options are phenomenal but need the utmost security and safety measures. However, the onset of leveraging the entire stream of cybersecurity mechanisms powered with advanced technologies will ensure the utmost security of all types of payment methods.

Multi-Financing Options

The credit market is now flourishing with innovative offerings from fintech. Unlike in the past businesses that got started then, had to face several difficulties in getting loans from old-fashioned banks. The introduction of new fintech services such as P2P loan platforms has enabled receiving loans seamlessly with faster payback methods.

Surpassing Financial Exclusion

With the fintech revolution, banking has become more accessible and convenient for all types of users. Apps like Google Pay, Square Cash, Jupiter Money, Sage Pay, and many more have promoted the idea of performing all transactions at the fingertips.

More Investment Opportunities

From traditional investment methods to exercising safe investment practices online, Fintech apps have helped users learn the ways of investment through digitization. The very traditional investment sector is now evolving and fintech disruptors are breaking the barriers of accessibility. Some of the top examples are Acorns, Coinbase, Robinhood, and many others.

Features You Must Have in Your Fintech Application

You must ensure your Fintech app is developed at least with the below key features to give better user experiences:

Login/Sign in Facility

This feature must be your first page for users to create their accounts by signing in and logging in to access personalized user experiences. Make sure to use the most advanced designs that can implement important security app login features like biometric unlock/authentication and two-factor authentication, to avoid fraudulent risks and theft.

Payment Gateway

The feature of payment gateway integration will help users connect with their preferred bank accounts for making online payments or through cards with your FinTech app. This will make your payment transaction journey simple.

Account Management

Once user sign in or create an account, they must add their key information to get the convenience of use. The feature also allows users to add additional information to their account including name and contact information, security settings, managing privacy, automating payment transactions, checking balance, and setting budgets.

Push Notifications

Push notifications are essential for reminding users to use the app. It also helps marketers to play with the marketing tricks and improve user retention ratios.

Chatbots

To get quick answers to any common queries of users, chatbots have remained effective so far. It diligently can serve customers with satisfactory answers through its AI-driven technology allowing users to chat with AI-powered bots. These chatbots enhance user experiences and improve your business to a great extent.

Transaction History

When you check the account balance, users also want to know the way they spend money and the entire transaction history. This feature helps them review past transactions, withdrawals, deposits, purchases, and more. It also provides other transaction details like dates, times, and a complete statement of financial records.

Points to Consider When You Develop Your Robust Fintech App

If you want your fintech app to be perfect, you must consider the below set of points to ensure your app development project turns out to be a success.

Third-Party Integrations

They are APIs that can help you strengthen your fintech app functionality. When you develop your fintech app, ensure to follow the below set of standards while integrating various third-party APIs:

- KYC API Integration

- AML API Integration that embraces anti-money laundering services

- Linking payment gateway with bank accounts and payment cards.

Security

When you develop your fintech app, security should be your major concern. Various government and non-government regulatory authorities have established financial regulations to ensure financial and investment security. If your app does not follow these standards, it may be attacked by hackers anytime.

Hence, you ensure the tightest security of your app must have security features like two-factor authentication and biometric unlock. Also, when you develop a cloud-based application, you must consider cloud security best practices for ensuring security.

Legal Compliances

You can protect your fintech app from cyberattacks by complying with the legal security guidelines that help you implement best app security practices. These regulatory standards are based on various services that you provide and provide you with user information.

For example, if you store cardholder information, you must comply with PCI-DSS regulations. If you are dealing with a user’s personal information, comply with GDPR guidelines. When you practice these two, you can optimize your fintech app and ensure seamless online operations.

Simplicity and Usability

Keep your app UI simple and easy to understand. Design your mobile app in such a way that it appeals to users to engage and gives meaning to their lives. Users must enjoy using your app and you must be able to reap the benefit of their higher engagement ratio. Simple and soothing apps with understandable UI will extend the scope of acceptance and user engagement.

Steps to Develop a Fintech App

Just like any other mobile application, fintech apps go through a detailed, guided, and systematic process of development phases. We have tried to help you understand the basic steps that you must follow to ensure your app is a sure success:

Establish your fintech app development idea

- Find out core issues in the market and understand how your app can address these challenges.

- Answer questions like the type of fintech app you want to build and which problem areas will you solve. With such questions, you get to a niche point that might be a perfect choice for your fintech app.

- Do the mobile app market research and user research.

- Define market, types of users, and institutes by asking questions like

- Which financial domain your app is targeting?

- Who are your app users and what is their core profession?

- What is the age group, area of interest, and region of your target audience?

- What will be the scope of your app national or global?

- Who are the competitors of your app?

- What features do you want in your fintech app?

- Besides the above questions, you can also ask other relevant questions and get answers for deeper clarity.

Do research on user experiences

- Understand the pain points of your audience by doing rigorous research.

- Find out how you can make their journey smooth and make them like your fintech app

- When you do detailed UX research, you must find out the unique points that can engage and amaze your audience

- Detailed UX research, knowing your audience, and finding unique value propositions along with SWOT analysis is the perfect way to begin with your research.

Establish the scope of the product

- Your product is designed based on so many things and elements. There are features, functionalities, better ideas to create designs, framing marketing strategies, and so much more.

- When you look into all these ideas, you may feel overwhelmed. But, digging deep into your research, you will get a clear path to starting with your successful fintech app and will take you through the entire scope of the product.

- Here, SOP (scope of the product) comes to the rescue.

- SOP is a detailed analytical report about your app development project and talks about the product description, goals, objectives, deliverables, assumptions, scope boundaries, and much more.

Find the right technology and app development model

- Your idea can be put to life only by executing and implementing some of the best technologies.

- You need an experienced and highly qualified fintech app development company that can harness the power of the latest technologies to execute your project beautifully.

- You need to be with the trend and choose the best option suitable for your business.

- The technology options can be either native fintech mobile applications or cross-platform fintech mobile app development.

- Some of the emerging technologies that can be used in fintech app development are Data Science, AI/ML, and Blockchain.

- Secondly, you must also choose the app development approach either from Waterfall Scrum, or any other Agile methodology.

Select the right IT team and appropriate engagement model

- It is now time to choose the right IT development engagement model that can meet your criteria effectively.

- A clear project scope can be executed with a fixed-cost hiring method.

- If the project has various other requirements, you can experiment with other methods like hourly hiring.

- Finding the right mobile app development partner and interviewing developers will be the next important step.

- Go on their websites and check their portfolios, and success stories and try to find out how they can make your app faster and seamless.

- If possible, you can contact them and share your project requirements, discuss the problem areas, and find solutions with their assistance.

Follow the fintech compliance

Ensure you follow all the compliance guidelines and regulations like GDPR, PCI-DSS, and many other

Also, find out the protection systems like KYC and AML that will safeguard user information from scams and online fraud.

Laws vary from country to country, so find out the laws of other countries if you are targeting an international audience as well

Create UI/UX designs

Your fintech app must have appealing UI/UX designs and must ensure your users get a smooth and amusing journey to your app.

When you create your app, make sure your UI/UX designs do not show errors and mistakes and must be created keeping in mind the latest trends and fashion

The app should look creative and appealing and must resonate with the user’s pain points.

Develop smart MVP

- Now when you have finalized everything for the project to begin, the next thing is to build an MVP of your fintech app.

- MVP does not need effective UI/UX designs. However, it needs to showcase the real purpose of building your app and must include the core app features and functionality.

- Initially, you need to market the app and find out the level of interest your target audience shows.

- MVP will save a lot of time and money. It will help you check the viability of your idea and how effectively are your product features implemented into the fintech app.

Build app, test, and take feedback for further iterations

- This is the main phase of your product development. It is also known as the iterative app development process.

- After you develop your app, you must use the best app store platform to launch it for your target audience.

- You may need continuous improvements to improve the effectiveness of your app and keep on updating it regularly.

- You can conduct an A/B testing here and find out which is the best version your customers will like.

- You can check the performance of your app by analyzing the below parameters or KPIs:

- Customer retention rate

- Daily/monthly active users

- Average transaction time

- Users’ time spent on your app

- Times app gestures become unresponsive

- Apps visit from push notifications.

Mistakes You Must Avoid While Developing a Fintech App

Avoid the below mistakes and know the right approach to develop your fintech app.

- Do not overlook the potential of creativity in designing app user onboarding screens. Keep it impactful and appealing, as it gives the first impression.

- Do not make the app cluttered with too many features and functionalities

- Do not miss out on adopting a user-centric approach to design your fintech app. This is possible only by proper market research.

- Do not ignore the importance of security while delivering fintech solutions

- Cleanse your data regularly and keep it up to date with necessary information. It can help reduce data errors and inconsistencies during data retrieval.

- If you do not give your fintech app for testing to certified QA engineers, it may hamper the app development quality. Hence, fintech apps need financial testing with respective financial industry regulations.

What is the Cost of Developing a Fully Featured Fintech App?

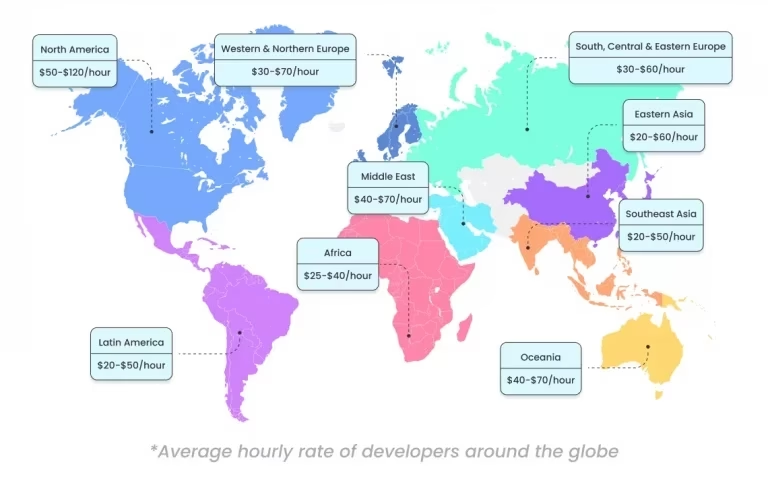

The cost of developing a fully featured fintech app is based on the organization’s unique proposals it has to offer. The fintech app development cost is influenced by various factors:

- Fintech app design needs

- Fintech app development type with complexity

- Location of app development company

- Technology stack

- App features and functions

- Total number of designers and developers you hire

- 3rd party API integration

- App testing

- Type of fintech app development engagement model you choose

Here is a simple map that gives you information on the average app development cost based on the location:

How Can Softqube Technologies Help You Create the Best Fintech App For Your Business?

We conclude this guide, hoping that now you are well-equipped with enough knowledge about developing a fintech app. How far did it help you in setting up the scope of your fintech app project? Fintech apps are helping users who are not just consumers but also finance business houses.

Softqube Technologies is a leading fintech app development company holding immense expertise in building robust fintech apps that can help you transform the way you deal with your finances. Innovating and brainstorming are close to our hearts, and so our clients admire our work globally. We have helped them revolutionize their financial business operations, enabling them to improve their business profitability and productivity.

Contact us today to learn more about our services!

FAQs

Is it the right time to launch a fintech app for my business?

Post-pandemic, many tech-savvy consumers are looking for seamless contactless digital financial services that can easily manage their daily finance operations. Moreover, the rising security concerns have influenced the fintech industry to create innovative and highly secured apps that can safeguard users’ information and finances.

What is the exact timeline for developing a Fintech App?

It is difficult to find the exact timeline for building a fintech app. We need to know the exact requirements of your business and based on several factors like app complexity, no. of screens you want, and the kind of developer expertise it demands, we decide the timeline. You can share your app development requirements today with us.

How can Fintech apps help me make money?

Fintech apps can be monetized in several ways. You can implement various features like in-app advertising, partnering with other financial institutions, charging transaction fees, offering APIs or other developer tools, and much more.

Share on